About Paypal Business Loan

Wiki Article

Paypal Business Loan Things To Know Before You Get This

Table of ContentsOur Paypal Business Loan StatementsTop Guidelines Of Paypal Business LoanSee This Report about Paypal Business LoanPaypal Business Loan - QuestionsPaypal Business Loan Can Be Fun For EveryoneAll About Paypal Business LoanPaypal Business Loan Things To Know Before You BuyNot known Details About Paypal Business Loan The smart Trick of Paypal Business Loan That Nobody is Discussing

You will certainly be representing your business and stating your instance as to why the lending institution need to consider you deserving of a funding. This takes some preparation on your part. You will certainly require to have a solid business strategy and a comprehensive explanation of exactly how you will utilize the cash. It likewise assists to include just how this money would aid you grow your business's yearly profits.Don't fail to remember to dress professionally and also to ideal your lend a hand individual and in writing, simply in situation they require an on the internet lending application. The authorities in the banking industry desire to see numbers, but they are human (primarily) as well as can be gained by a good personality and also means with words.

Getting The Paypal Business Loan To Work

If you have a money flow of $5000 per month and your finance payments would certainly be $2500, your DSCR is 2 since your loan repayment is half your income. Needless to state, the greater your DSCR, the better your possibilities of obtaining the financing.

What Does Paypal Business Loan Do?

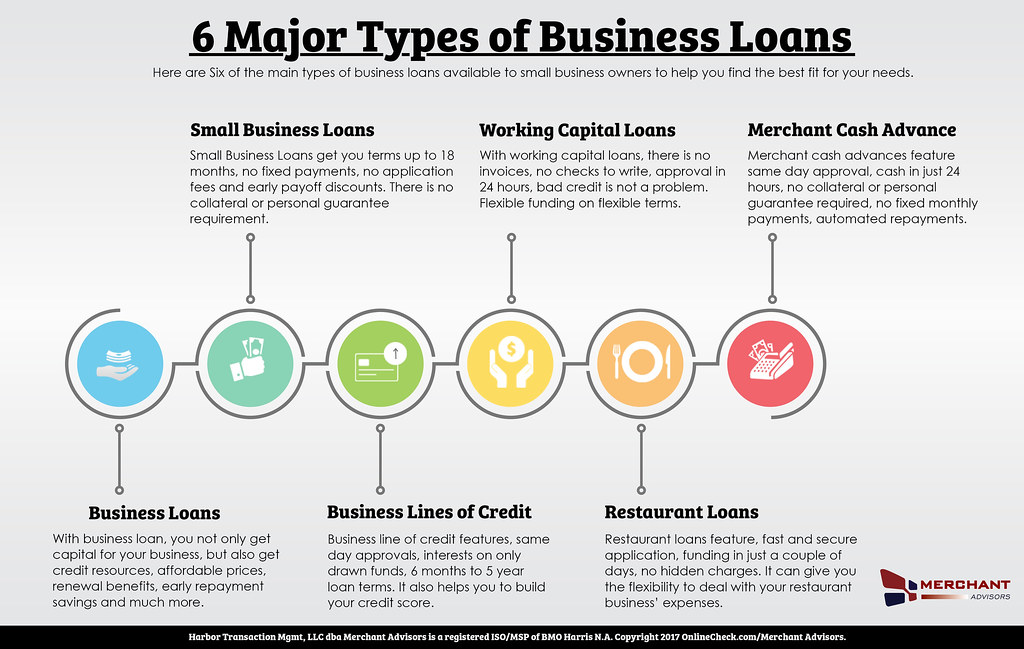

Not just does this show that you think sufficient in your own company to put your possessions on the line, however in some cases business doesn't have sufficient security to cover the car loan amount. If you desire others to risk their funds for your service, you need to be ready to risk your own. PayPal Business Loan.This is especially real when you are checking out the different kinds of car loans offered to you. Right here are several of the most usual kinds of bank loan: The united state Small Service Management produced this financing program to aid develop more business opportunities in the country as well as, in turn, promote a far better economic situation.

Paypal Business Loan Fundamentals Explained

These car loans are generally protected by organization assets. Receivers have the liberty to use these funds for whatever company requires they please. A functioning resources car loan is a short-term financing to assist the business survive when capital is short. These loans can be utilized to pay pay-roll, overhead, or debt.Nonetheless, you need to be mindful that you will be anticipated to pay the loan back completely rather swiftly (normally much less than year). This kind of loan resembles an individual credit score card, but it is available in the kind of a separate savings account for your organization.

The Only Guide for Paypal Business Loan

It is very adaptable but typically includes a higher rates of interest. When searching for a bank loan, there are a few various things that you should keep your eyes as well as ears open for. Let's break down these elements of a loan as well as how the different sorts of car loans place for these aspects.The longer you have to wait to obtain your funding, the even worse your financial circumstance can get. If you are in dire demand of cash to maintain Full Article your service afloat, the rate of funding need to be among the top concerns in your choice of funding. The fastest approach of company funding is a vendor money breakthrough.

More About Paypal Business Loan

As great of an offer as SBA car loans are, this is where they drop short. SBA car loans can take months to process.

Some Known Details About Paypal Business Loan

Big banks generally have more stringent requirements, making it extra challenging to safeguard funding. They can generally provide better prices, and also you'll understand that you are obtaining from a trusted source. Little financial institutions might be much more ready to lend to organizations in their home town considering that they understand the company as well as business owner.As well as, it can be demanding to think about how challenging as well as lengthy the repayment of these loans can come to be. No person wishes to accumulate organization debt. If you are careful concerning committing to a tiny business lending, you do have some company funding alternatives that are a little easier to safeguard (as well as occasionally extra affordable).

All about Paypal Business Loan

You likewise have the flexibility to borrow when you need from the assent as well as pre-pay when you have surplus funds. Here, you pay interest just on the Visit Your URL amount made use of.

Paypal Business Loan Things To Know Before You Get This

The quick response is "Extremely crucial". When it comes to small company loaning, owners and also their business are seen as one-and- the- very same. Small company owners generally put in a lot of impact over their firm so lending useful content institutions put a hefty emphasis on the proprietor's debt profile. The far better your credit rating and also credit history (FICO), the far better the chances you will obtain a financing; and also, likely on much better terms.Report this wiki page